how to pay indiana state estimated taxes online

Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill. To make a payment via INTIME.

Individual Income Tax Payers Added To Indiana Online Tax Portal Intime

Estimated payments can be made by one of the following methods.

. Find Indiana tax forms. The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax account s in one convenient location 247. When prompted provide your taxpayer identification number or Social Security number and your liability number or warrant number.

Find Indiana tax forms. The 2021 Indiana State Income Tax Return forms for Tax Year 2021 Jan. Search by address Search by parcel number.

Indiana has a flat state income tax rate of 323 for. You may qualify to use our fast and friendly INfreefile to file your IT-40 IT-40PNR or IT-40RNR directly through the Internet. Indiana has a flat state income tax rate of 323 for the 2021 tax year which means that all Indiana residents pay the same percentage of their income in state taxes.

Indiana Income Taxes. Unlike the federal income tax system rates do not vary based on income level. Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources.

Claim a gambling loss on my Indiana return. Have more time to file my taxes and I think I will owe the Department. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Rates do increase however based on geography. This option is to pay the estimated payments towards the next year tax balance due. If you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penalty.

Claim a gambling loss on my Indiana return. Once logged-in go to the Summary tab and locate the Make a payment hyperlink in the Account panel. Thank you for your patience during this maintenance period.

Effective May 1 2022 the gasoline use tax rate in Indiana for the period from May 1 2022 to May 31 2022 is 0241 per gallon. Pay my tax bill in installments. If you owe 1000 or more in state and county tax thats not covered by withholding taxes or if not enough tax was withheld you need to be making estimated tax payments.

If you did make estimated tax payments either they were not paid on time or you did not pay enough to. Have more time to file my taxes and I think I will owe the Department. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable.

You should also know the amount due. For more information on the modernization. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form.

For more information on the modernization. If you are having trouble searching please visit Assessor Property Cards to lookup the address and parcel number. 01-20-2022 Individual Income Tax Filing Opens Jan.

Take the renters deduction. The Indiana Department of Revenues DOR current modernization effort includes the Indiana Taxpayer Information Management Engine INTIME DORs e-services portal for customers to use when managing individual income tax business sales tax withholding and corporate income tax. 218-2017 requires the department to publish the new rates effective July 1 2021 for the gasoline license tax IC 6-6-11-201 and special fuel license tax IC 6-6-25-28 on the departments Internet.

Take the renters deduction. In the top right corner click on New to INTIME. For best search results enter a partial street name and partial owner name ie.

To make payments toward a previous tax year filing please select or link to the Individual Tax Return IT-40 payment option. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due date.

Only break out your spouses estimated county tax if your spouse owes tax to a county other than yours. Know when I will receive my tax refund. Paying online Filling out ES-40.

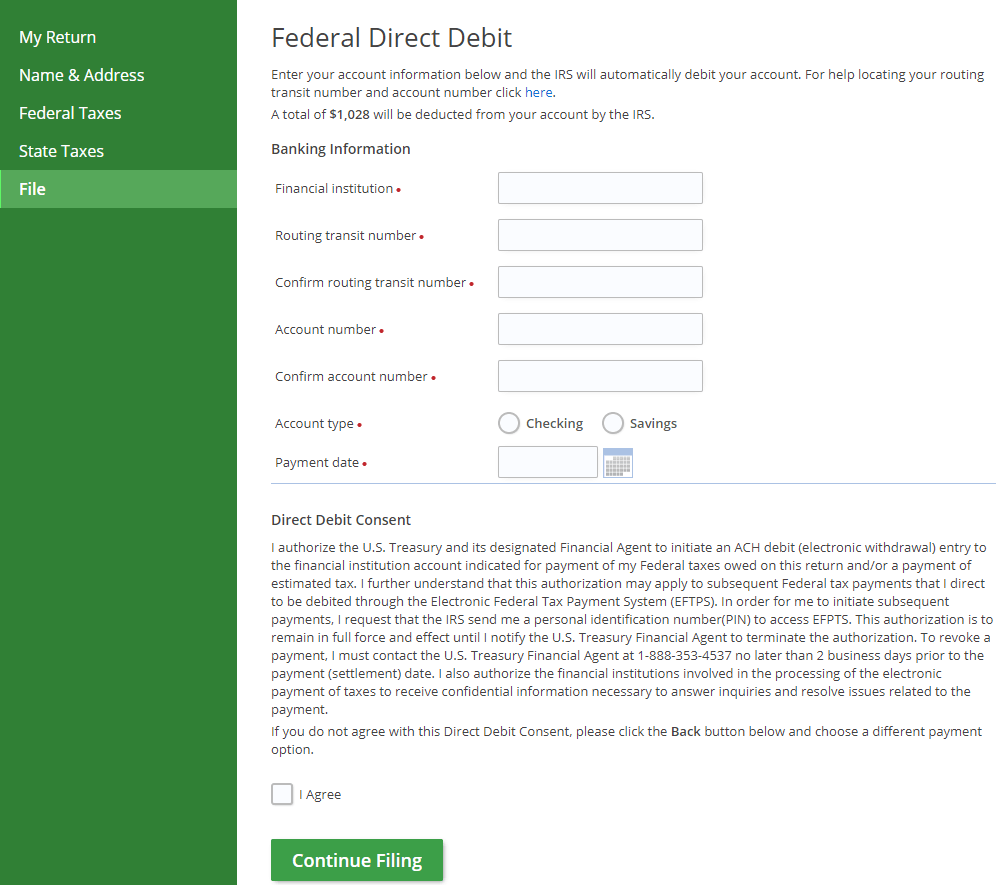

Access INTIME at intimedoringov. INtax only remains available to file and pay the following tax obligations until July 8 2022. Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply Make a payment in person at one of DORs district offices or downtown Indianapolis location using cash exact change only personal or cashiers check.

This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service. Pay my tax bill in installments. Ir a la herramienta ahora.

124 Main rather than 124 Main Street or Doe rather than John Doe. Search for your property. Know when I will receive my tax refund.

The tax bill is a penalty for not making proper estimated tax payments. Estimated payments may also be made online through Indianas INTIME website. Only break out your spouses estimated county tax if your spouse owes tax to a county other than yours.

The option to make an estimated payment will appear in the Payment. We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest. If the amount on line I also includes estimated county tax enter the portion on lines 2 andor 3 at the top of the form.

Individual Estimated IT-40ES Payment. If the amount on line I also includes estimated county tax enter the portion on lines 2 andor 3 at the top of the form. However if you owe Taxes and dont pay on.

The Indiana Department of Revenues DOR current modernization effort includes the Indiana Taxpayer Information Management Engine INTIME DORs e-services portal for customers to use when managing individual income tax business sales tax withholding and corporate income tax. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. The Indiana Department of Revenues DOR new online e-services portal INTIME now offers customers the ability to manage their tax account s in one convenient.

Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Using a preprinted estimated tax voucher that is issued by the Indiana Department of Revenue DOR for taxpayers with a.

Cigarette Taxes In The United States Wikipedia

Buffett Malone Explore Investment In Sprint Sources Investing World News Today Sprinting

Private Prisons In The United States The Sentencing Project

Dor Owe State Taxes Here Are Your Payment Options

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Indiana Dept Of Revenue Inrevenue Twitter

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Pin On Play State Lotteries Az Ca Ct Florida Dc

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Where S My State Refund Track Your Refund In Every State Taxact Blog

Dor Keep An Eye Out For Estimated Tax Payments

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

How To Pay Indiana Taxes With Dor Intime R Indiana

Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check